Earned income is required to be able to take the SE health insurance deduction. Per the worksheet instructions for line 29 of the Form 1040: 'If you were a more-than-2% shareholder in the S corporation under which the insurance plan is established, earned income is your Medicare wages (box 5 of Form W-2) from that corporation.' Overview This article will help you: Add a payroll deduction item Edit a payroll deduction item Delete a payroll deduction item Details A.

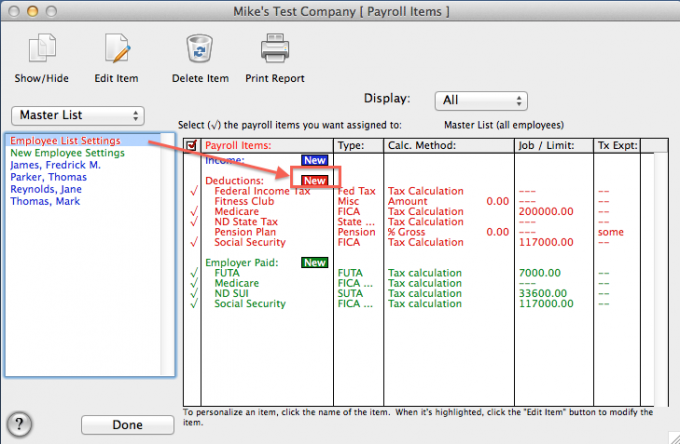

Hi, Yes, you can use the payroll deduction setup for any employee medical insurance like Aflac. Let me show you how to it:. Go to Employees and select the name of the employee. Click on the Edit icon for Pay. Click on the Add a new deduction link. Select New deduction/contribution. Select Health Insurance.

Select Medical for Type. Enter the name of the provider (Aflac). Enter the amount to be deducted every pay period and Annual Maximum (optional). Choose either Taxable insurance premium or Pre-tax insurance premium.

Click on OK. QuickBooks Online will automatically create a liability account for this medical insurance. You can review the account setup by going to Payroll Settings, and then Accounting under Preferences.

When you're about to pay this medical premium, you can go ahead and create a Check. Just select the liability account for this medical insurance. You may also create a journal entry to debit the funds from the liability account to any clearing account you've created. If you have more payroll questions, I'd be glad to help.

Just post them here. Hi, Yes, you can use the payroll deduction setup for any employee medical insurance like Aflac. Let me show you how to it:. Go to Employees and select the name of the employee.

Click on the Edit icon for Pay. Click on the Add a new deduction link. Select New deduction/contribution. Select Health Insurance.

Select Medical for Type. Enter the name of the provider (Aflac). Enter the amount to be deducted every pay period and Annual Maximum (optional). Choose either Taxable insurance premium or Pre-tax insurance premium. Click on OK. QuickBooks Online will automatically create a liability account for this medical insurance. You can review the account setup by going to Payroll Settings, and then Accounting under Preferences.

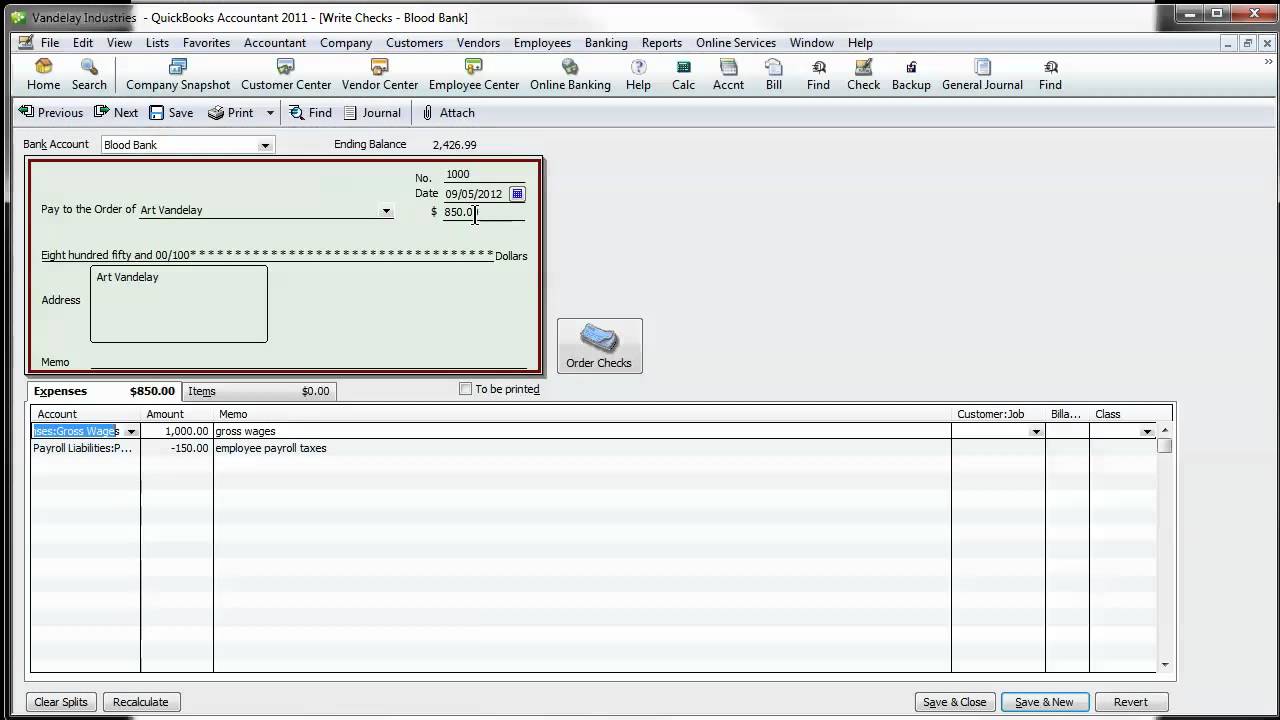

When you're about to pay this medical premium, you can go ahead and create a Check. Just select the liability account for this medical insurance. You may also create a journal entry to debit the funds from the liability account to any clearing account you've created. If you have more payroll questions, I'd be glad to help.

Just post them here. Hello everyone, you all have great questions and I will be happy to answer all of them. I will tag each of you with the answer to your individual questions to help avoid any confusion. Provided some great steps for setting up a deduction and contribution in QuickBooks Online. You would use the same steps provided, but instead of setting up a deduction you would set up the company contribution section. This will allow you to track how much is being paid for them, while not actually paying it to them. To add a deduction in QuickBooks Desktop, check out this.

To create a Journal entry, please follow the steps in this. You can add the reimbursement pay type by following the steps. The system automatically will apply the applicable taxes. If you'd like to let me know which payroll product you are using I will be happy to provide the best way to get this working the way your CPA prefers. If anyone has any further questions, please don't hesitate to reach out! I want to make sure everyone is able to get this set up the way they need to.

Add Health Insurance Deduction Quickbooks For Mac 2016

Record the gross payroll amount as an increase to the salaries expense account. The gross payroll amount is the total amount of payroll before you take any deductions for taxes, insurance or garnishments. Record the total amount of taxes withheld from the payroll checks as an increase to the appropriate payroll taxes payable general ledger account. Common taxes withheld from payroll checks include Social Security, Medicare/Medicaid and federal withholdings. Those expenses are recorded in the payables account because you will remit the amounts to the appropriate tax collecting agencies, such as the Internal Revenue Service. Record the total amount of health insurance premiums withheld as a decrease to the health insurance expense account. That entry will reduce the total cost of the health insurance premium paid by the amount of premium deductions withheld from the payroll checks, properly reflecting the actual business expense on the accounting general ledger and income statement.

Tips. If you are not certain how to record payroll entries or set up general ledger accounts for health care premium expense, hire an accounting professional to assist you with general ledger setup and to explain how to properly allocate payroll expense to the general ledger. Many payroll software packages allow you to assign general ledger account numbers/names to each aspect of payroll, such as gross payroll and Social Security withholdings, and can provide a report that lists the specific accounts and total amounts to post to each account after you process payroll. Setting up this option if it is available will save you time and mistakes in the long run.